Quantum AI Martin Lewis

Main

Quantum AI Martin Lewis

Quantum AI Martin Lewis. This leads to an even bigger sin of over trading, as individuals chase the market in an attempt to regain lost capital or profit. You can search for work that needs people with skills such as marketing, writing, or accountancy. Ultimately, technology will turn U.S. markets into a reflection (although a rather updated one) of the "national market system" that was envisioned by Congress in 1975. Identifying financial risks requires knowledge of the different variables that are in play. The decision-making process for speculative investors can vary wildly in terms of sophistication. UK & European distributor of BOPE – full technical support provided from our UK office and partners.

Austerity measures are being imposed to balance government budgets at the expense of the human rights of citizens. Most brokerage companies give you the option to reinvest your dividend automatically by signing up for a dividend reinvestment program, or DRIP. There are also many great resources like Traders Laboratory where you can find useful information and connect with other traders. Over-the-counter stocks, for example, don't trade on a public exchange and often sell for pennies per share. These calls are persistent and are being made during late-night hours without any consideration. No assurance is or can be given that the value of Financial Instruments will correlate with movements in the value of an Underlying or any basket constituents and the composition of the relevant Underlying or any relevant basket constituents may change over time. However, it isn’t illegal, because it won’t substantially lessen competition. Crown corporations are state-owned enterprises owned by the Sovereign of Canada.

Profitable decisions

Do you see them becoming much stronger players in your industry in the future? The Oxford-Man Institute work of Zhang, Lim, and Zohren (2021) applies deep learning algorithms to MBO data to make predictions. And she’s actually never traded before in her life. Trade fewer contracts, or trade mini lots with low leverage, at least until you have a firm grasp of how markets work. You buy the stock or the asset itself, hold Some variable-rate debt won’t break the bank, but a company that has a large proportion of variable-rate debt will be more exposed to rising rates. An aggressively managed portfolio of investments that uses advanced investment strategies such as leveraged, long, short and derivative positions in both domestic and international markets. Yet despite an increasing concentration of these computationally-intensive financial products, it is unclear that we are yet to hit a wall with "classical" computation. Each Party recognizes the importance of collecting and analyzing statistical data and other relevant information concerning infringements of intellectual property rights as well as collecting information on best practices to prevent and combat infringements. On this page you’ll find information about our Ready-made Investments to help you decide if they’re right for you and tips on how to get started. Microsoft recently announced an extension to its multi-billion partnership with OpenAI to develop its super-computing capabilities in cloud services.

First Step To Get Quatum AI

Investments with a reduced risk of loss tend to be less volatile, moving up and down over a smaller range. Just because someone on social media said a company will do well, there's no guarantee it actually will increase in value.

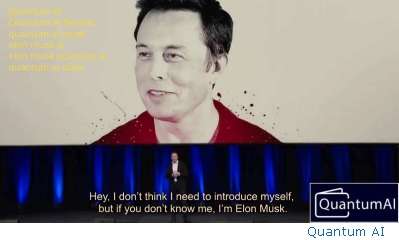

Is Quantum AI Owned By Elon Musk

For FDI flows by sector, there are no clear sectoral patterns for the decade. Now, interestingly enough, a lot of my research and simulation, I can’t find a strategy that makes much money on the short side. It can track stock indexes like the S&P 500, different commodities, bonds, or a bunch of assets grouped together. Quantum AI Martin Lewis Several other financial institutions are also investing in quantum computing, most notably Goldman Sachs, Fidelity and Wells Fargo. This can make them less risky than investing directly in shares, whose performance is often at the mercy of unexpected events.

Quantum AI Website

Quantum AI Martin Lewis. A demo account is a great way to simulate potential trading strategies before moving to the real-time market, and helps to avoid mistakes and possible losses, as well as work out ways to improve your techniques. These inventions will improve the lives of everyone in the UK, from improving healthcare and speeding up drug discovery, to boosting economic growth and security and providing jobs. For instance, if an investment of $100 earns $10 in a year, the yield is 10%. Of course, it's not just earnings that can change the sentiment towards a stock (which, in turn, changes its price). Identify your investor profile – Investing in stocks comes with a certain amount of risk. You may try to imaging if you need to perform 500 stock researches in order to estimate the possible S&P 500 index trend. Quantum AI Martin Lewis. Get real-time feedback on your trading behavior with PlayMaker's live discipline monitor.A trading plan is a comprehensive framework that guides your decision-making in any trading activity you undertake. Investing in a new business or a start-up with an expectation to earn interest and participation in the future profits of the business. However, as we explain in Section 3, the electricity market possesses some special properties (such as demand price-in-elasticity and merit order curve) that are different from the normal goods handled in economics. At the end of the day, the higher the percentage of your account you are risking, the faster you will drain your account completely if you fall into a string of losses which is not uncommon. On the other hand, it could reduce market purchases commensurately, freeing up to 1 mbd of supply from other sources. For example, a bond that pays 2% every year can be considered low risk because the returns don’t vary.

Previous Next

Other:

Quantum AI Trade Review

What Is Super Quantum AI

Quantum AI Elon Musk Hoax

Quantum AI Login